Germany is one of the few developed nations to have experienced hyperinflation during the last century. The Weimar period is often studied as one of the most destructive examples of hyperinflation in history. As a result of this period of monetary turmoil, which caused untold misery across the nation, Germans are relatively distrustful of banks and remain the most frequent users of cash in the world. The monetary policy of the Deutsche Bundesbank is known to err on the side of caution when it comes to managing risk and ensuring sound currency.

However, since the 2008 subprime mortgage and the more recent economic difficulties of certain Eurozone members, the European Central Bank has pursued a more aggressive policy in terms of monetary issuance. Not all Germans are comfortable with this approach, nor the high level of bad loans and exposure to risky derivatives maintained by Deutsche Bank AG, the country’s largest bank. Such concerns, heightened after the ECB’s aggressive response to the Covid pandemic, are leading many ordinary Germans to consider hard money alternatives to the banking system, such as gold and Bitcoin.

German technical enthusiasts and experts have long been at the forefront of Bitcoin innovation and adoption. Since at least 2011, Berlin (and its Kreuzberg district in particular) has been renowned for its strong hacker culture. Germany has thus served as the vanguard of the Bitcoin movement across Europe – perhaps even the world. As demonstrated by recent Lightning Network hackathons held in Berlin in 2018, nothing has changed in the intervening years. Furthermore, investments into Bitcoin in Germany investment are exempt from capital gains tax if held for longer than one year.

We believe that the combination of these three factors, namely technological expertise, appreciation for hard money, and relatively favourable tax treatment, will ensure that Germany remains an important player in the Bitcoin world. If you’re based in Germany and interested in buying Bitcoin, this article will get you up to speed on all relevant laws and the best buying methods.

Our article begins with the current tax and regulatory situation in Germany. We then present a step-by-step guide to buying Bitcoin, which explains how easy it is for our German users to purchase bitcoins using their credit / debit cards or SEPA bank account.

German Bitcoin Regulations

Germany was the first country in the world to classify Bitcoin and other cryptocurrencies as a “units of account,” way back in August of 2013. This means that German authorities recognise Bitcoin as a form of private money. Bitcoin is not considered fully equivalent to the currency of another nation, as it’s not issued by a central bank, but it’s in the same ballpark. Germans are therefore free to use bitcoins to pay one another, just as they’d be free to use gold or USD, provided that all parties agree to such usage.

Germany’s Financial Stability Committee issued a report in mid-2018 in which they state that cryptocurrencies do not pose a threat to the nation’s financial stability. Given such pronouncements and the fact that certain government agencies, such as the National Tourist Board, are accepting Bitcoin, Bitcoin users in Germany have no reason to fear heavy-handed government regulation of the crypto sector.

In late 2019, the Bundesrat passed a bill enabling the country’s banking sector to participate in the sale and storage of crypto, confirming Bitcoin’s status as a legal asset for the forseeable future.

Taxation of Crypto and Bitcoin in Germany

The German Finance Ministry has confirmed that bitcoins (and other crypto) are exempt from VAT when used as payment for goods and services. However, this exemption only applies on amounts below €600, according to the NoMoreTax.eu European tax advisory service.

German users can also celebrate the nation’s enlightened approach to crypto capital gains. By holding crypto for a period of longer than a single year, any capital gains are entirely exempt from taxation. This rule positively encourages holding (or “hodling,” to use the slang term) Bitcoin over the long term, which is considered by many as the safest and most reliable investment strategy.

These favourable taxation and regulation policies combine to make Germany something of a crypto tax haven.

How to Buy Bitcoin in Germany

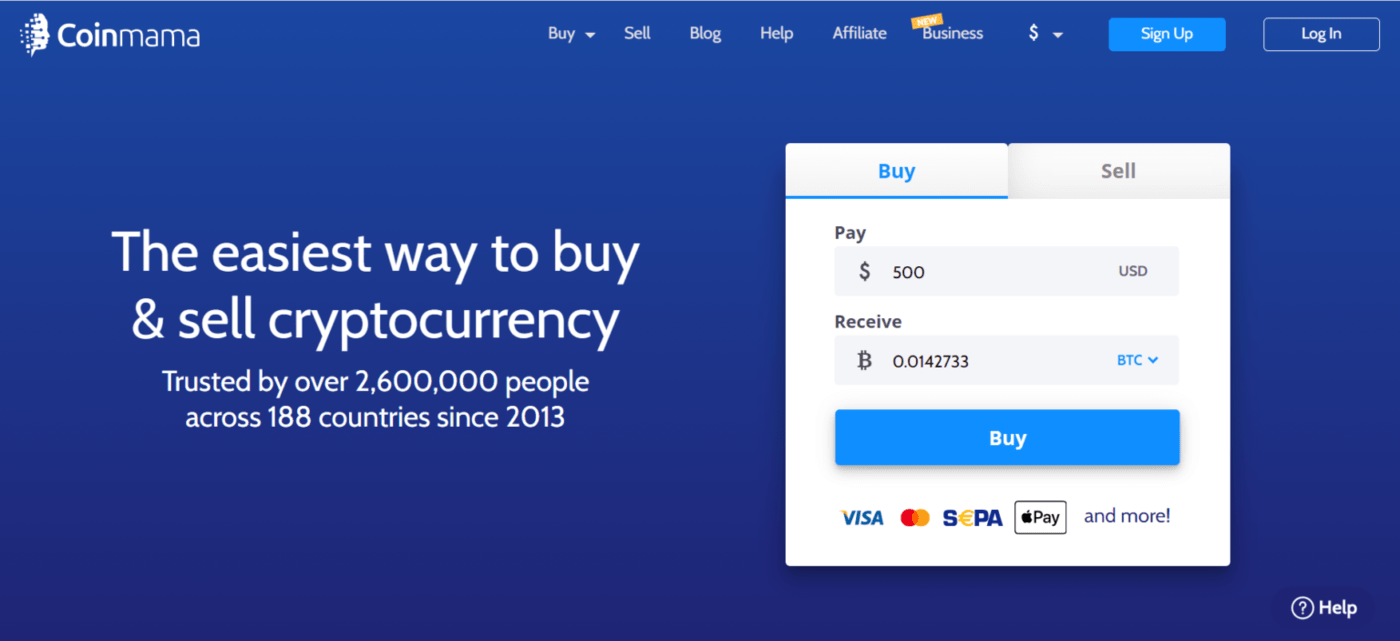

Coinmama lets people in 188 countries around the world, including Germany, buy bitcoin (BTC) with any debit or credit cards issued by MasterCard or VISA. This is perhaps the fastest and simplest way for Germans to buy bitcoin. In most cases, you’ll get your bitcoins in less than half an hour.

Additionally, residents of Germany may use our new SEPA bank transfer method to buy Bitcoin. This option allows you to purchase bitcoins with Euros via any SEPA region bank account. The only rule to keep in mind is that the bank account must be registered in your own name. Bank transfers have lower fees and higher limits than card purchases but aren’t as quick. Sometimes the process can take as two business days.

Whichever method you decide on, here’s how to go about buying your BTC from Coinmama, in 4 easy steps:

Step 1 – Create Your Coinmama Account

1. Head to the main corporate header menu and select the light blue “Sign Up” tab at the top right (or click here). Note: if you already have an account, just sign in via the “Log In” button with your existing login details (or click here).

2. Enter your email, password, first name, last name and your country of residence.

3. Look for an email from Coinmama asking you to confirm your account. Click the link in the email to complete the registration process.

** Note: for more information on how to create an account with us, click here.

Step 2 – Get Verified for Purchase

1. To purchase bitcoin (BTC), you first need to become verified.

2. It’s necessary to enter your personal information and upload your ID or passport, plus various other documents depending on which level of verification you wish to reach.

Our verification team works 6:00-23:00 UTC. If everything looks ok, you should be verified in about fifteen minutes during working hours, or as soon as we’re back at our desks. If we have a question about your documents or need more information, we’ll let you know. Once your account is verified, you’re ready to buy Bitcoin!

**Note: for further help with account verification, please click here.

Step 3 – Place your first order

1. Once signed in and verified, click the “Buy” button and select “Bitcoin”.

2. Next, choose the amount you would like to buy. You can select a package, or enter the fiat amount or crypto quantity you’d like to buy of up to roughly $5,000 (as of the time of writing) for card purchases or $15,000 for wire transfer purchases.

3. Supply your Bitcoin wallet address. The address you enter is where we’ll send the coins which you buy. You can re-use this address for subsequent purchases or get a new one from your wallet, at your discretion.

4. Then, select the “Go to Payment” button.

Step 4 – Complete your Checkout

1. Select your payment method. Users worldwide can choose to buy bitcoin with a credit card, debit card, bank transfer and now Apple Pay.

2. Enter your payment details and click the “Buy” button.

Note: For card purchases, kindly note that only cards issued by VISA or MasterCard are accepted. As for wire transfers, they usually take 1-2 business days to post. This means that when paying via wire transfer, you will get the rate at the time your money arrives at our account. This means that during times of high price volatility, you may get a rather different Bitcoin amount (either more or less) than expected.

Once payment has been made, our BTC transaction to your wallet’s address then needs to be confirmed by the Bitcoin network. In approximately 10 minutes, a Bitcoin payment will be broadcast from Coinmama’s wallet to the Bitcoin address you supplied in Step 3, point 3.

Note that during times of especially high traffic, your transaction may take longer than normal to appear as confirmed within your wallet. Ordinarily, the transaction will be confirmed within 10 minutes. For large amounts, this might take a little longer (up to an hour).

Conclusion

German users are in a fortunate position in terms of their local crypto laws and taxes, which are the envy of Bitcoiners in many other countries. The Bitcoin community and economy in Germany is healthy and growing. If you buy Bitcoin, remember to either keep it for over a year or spend amounts below €600 to avoid taxes.