Crypto scams are everywhere and there’s no way to recover your coins if you’re tricked. This guide shows you how to avoid these dangerous scams.

The Scam War

Internet scams are nothing new. Most people have grown wise to the “classic” scams, and no longer email their bank account details to supposed Nigerian princes, for example. Old scams become less effective as victims share their experiences, raising public awareness. Scammers must continually evolve their tactics to compete, resulting in an ongoing “arms race” between scammers and the public. Unfortunately, cryptocurrency has given scammers a whole new arsenal. This article is intended to counter these new crypto scams by raising awareness of how they operate.

Cryptocurrency, a Scammer’s Dream

Consider the irreversible and pseudonymous nature of crypto transactions. While great for honest people, these are also perfect features for a scammer:

- Irreversibility ensures that victims are unable able to claw back any lost funds. Even worse for victims of crypto scams is that, unlike scams conducted through traditional payment channels, victims have almost no chance of reimbursement or insurance coverage.

- Pseudonymity greatly reduces the risk of legal consequences, making scams easier and safer to conduct, and so increasing their prevalence. Receiving victim funds via crypto eliminates a scammer’s need for bank or payment service accounts. Such accounts often reveal a scammer’s location, limiting the scope of their deception, and serve as an obvious starting point for criminal investigation.

In addition to these features which greatly favor scammers, the crypto environment attracts an abundance of suitable victims. Consider how the complexity and novelty of cryptocurrency, coupled with its tremendous price appreciation since inception, tends to attract those who are particularly vulnerable targets… To put it bluntly, people who are both greedy and ignorant are highly susceptible to scams.

Recognizing Scams

1. Practice Common Sense

There’s a single golden rule which can help you to spot and avoid scams: if an offer seems too good to be true, it probably is!

When presented with an unbelievably good opportunity, ask yourself why it’s being shared in the first place. If you discovered gold in your back yard, would you keep it a secret, perhaps share it with your closest friends and family… or invite the whole world over to dig it out?

2. Do the Math

Many scams promise outsize profits in percentage terms. A good rule of thumb is that annual profits above 20% are suspicious – even 15% should raise eyebrows. Although some people have realized far greater returns through cryptocurrency investment, this was achieved at the risk of total financial loss. In other words, early crypto adopters gambled big on unproven technology and won big. By contrast, offers which “guarantee” great returns with zero risk are never to be trusted.

When assessing offers with a shorter-than-annual timeframe, always work out the compoundedyearly rate. In other words, calculate the profit if you were to continually reinvest the original sum plus profits. Often this amounts to a ridiculous return, for example a 10% weekly profit on $100 returns $12912 after one year.

3. Beware Appeals to Emotion

Investment decisions are best reached via rational deliberation. If an “investment” is presented by a charismatic showman amid much fanfare, look out! Any form of marketing designed to manipulate emotion by evoking greed, envy, pride, FoMO, etc. likely conceals a lack of credible substance. If you can’t quickly get past the hype to the numbers and facts, back away quickly.

4. Look Out for Subtle Inconsistencies

Scam sites often feature bad design and worse grammar. Legitimate sites can afford to hire professional writers and designers, whereas scam sites often do everything themselves, usually with poor results. Be wary of any enterprise which claims to highly profitable yet fails to convey a professional image.

5. Multi-Level Marketing is Red Flag

It’s very common for scams to offer people a financial incentive for bringing others into the scam. Growing the scam benefits the founders and provides the funds to pay off early investors. Read up on how Ponzi schemes work so you can better avoid them.

6. Be Patient

Looking to get rich quick is usually a recipe for disaster. Take your time and think it through. If you’re being pushed to invest ASAP, that’s usually a warning sign. Don’t worry about missing an opportunity through excess caution as there are always more opportunities waiting in this space.

7. Investigate Further!

You should never invest into anything without first conducting your own due diligence!

Finally, here’s some further reading on the psychological factors which make people vulnerable to scams.

Common Crypto Scams

Here are some common crypto scams to avoid:

1. Crypto Doublers

These tend to be the easiest scams to spot, as per the “too good to be true” rule. Generally they consist of a shoddy website promising to multiply any crypto you send them within a short timeframe.

The mechanism through which this multiplicatory magic is achieved is never clearly explained; sometimes crypto trading is mentioned, other times hacking of mining pools or the blockchain itself.

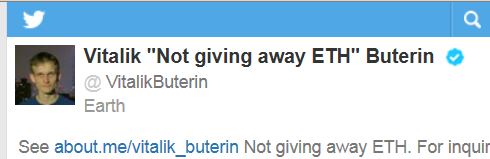

One recent variation of this scam relies on the impersonation of well-known cryptocurrency figures on social media. Vitalik Buterin was forced to change his Twitter handle in response:

Vitalik Buterin

2. Crypto Trading Systems

Scammers need a semi-coherent explanation for how they’re able to generate their extraordinary returns. One common explanation is “automated crypto / Forex trading.” Scammers claim to have developed some new trading system which generates consistent profits. Rather than keeping it to themselves and quietly becoming billionaires, they want to enrich random internet strangers.

In reality, such offers are almost always Ponzis. Crypto markets are so unpredictable as to make the idea of consistent returns almost ludicrous. If anything related to directional trading promises steady returns and doesn’t carry major risk warnings, it’s likely a scam.

3. Cloud Mining

Many newcomers to Bitcoin gain a superficial understanding of the mining process and assume that it’s a license to print money. In reality, mining is a tough, highly-competitive business.

Cloud mining apparently offers a way for the average person to get involved in mining… or at least, the illusory “easy money” type of mining, in which difficulty isn’t constantly rising and price is predictable.

This is not to say that all cloud mining operations are scams. However, so many have turned out to be Ponzis or otherwise deceptive that it’s generally ill-advised to participate in cloud mining.

4. Scam Coins

OneCoin and BitConnect were two prominent and blatant scams. OneCoin didn’t even have a public blockchain but BitConnect was more sophisticated. Both were Ponzi schemes which relied heavily on multi-level marketing, flashy ad campaigns and YouTube shills.

Without a solid knowledge of cryptocurrency, you’ll struggle to separate legitimate cryptocurrencies from scams. In this case, it’s safest to stick with the tried and tested coins, such as Bitcoin until you learn the ropes.

5. ICO Scams

Perhaps the greatest concentration of sophisticated scams is to be found in the ICO space. Satis Group, an ICO research and advisory firm, concluded that 81% of ICOs are fraudulent. This level of fraud has attracted the notice of financial regulators around the world. If you’re willing to risk an investment into ICOs, it would be advisable to stick with those which have been granted regulatory approval by major nations.