In keeping with our pledge to provide the best possible customer experience, Coinmama is excited to announce the addition of a brand new payment method: SEPA bank transfers. Starting from the 6th of August 2018, all our clients across the EU can buy Bitcoin, Ethereum, Ripple, and other leading cryptos with a simple, zero-fee SEPA transfer.

While credit or debit cards have proven to be a quick and convenient payment method for millions of crypto buyers around the world, SEPA bank transfers allow for much higher purchase limits and far more competitive fees. This makes our new SEPA payment facility a more economical option for our European clients looking to make large or regular crypto purchases.

Of course, our popular credit or debit card purchase methods remain in place and work exactly as before. The same pre-set or custom amounts of the same popular cryptocurrencies may be purchased – only the payment method will differ. Provided a purchase isn’t particularly time-sensitive, SEPA is likely to provide a great alternative to credit or debit card purchases, which have higher fees but are processed near-instantly.

Coinmama is one of the longest-running brokers in the business of supplying card buyers with coins, with the widest coverage of countries and some of the highest purchase limits, and we’re not about to change our winning formula. As an additional feature – and a frequently-requested one, at that – SEPA transfers allow us to expand our services to better cover the requirements of our valued clients.

The Advantages of SEPA Transfers

The SEPA (Single Euro Payments Area) bank transfer system is highly efficient, as its millions of daily users can attest. SEPA compares favorably with other traditional payment systems, as it combines speed and low fees with the convenience of sending a transfer from your regular bank account. When transfer costs are the prime consideration, it’s hard to find a better option than SEPA for conducting fiat transfers within the European Union.

Whereas the daily upper limit on our current credit or debit card purchase method is around €4,250 (or $5,000), the limit for SEPA payments payment starts around €10,250 (or $12,000). As such, SEPA allows for much larger crypto purchases.

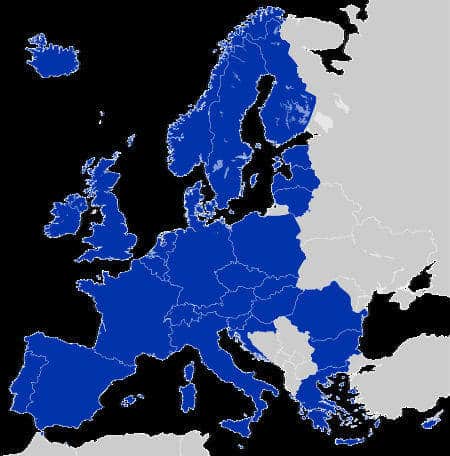

When taking advantage of Coinmama’s new SEPA funding method, you can expect a fiat transaction which is free of banking charges and credited to your Coinmama account balance within 24 hours. Furthermore, SEPA transfers should be available 24 hours a day, 7 days a week and 365 days per year, as this modern system is largely automated. Payments are possible from anywhere within the SEPA zone, as depicted below:

As an additional benefit for those looking to purchase large amounts of crypto, our current limits on SEPA payments are separate from our other funding methods. This means you could purchase 5,000 EUR worth of crypto via SEPA, plus an additional 5,000 EUR via credit/debit card, per day. If you often find yourself reaching our existing purchase limit, this will allow you to exceed it while keeping your business within our familiar, trusted service.

Supported Cryptocurrencies

From the 6th of August, you’ll be able to use SEPA transfers to make purchases from the full range of cryptocurrencies we support, namely:

- Bitcoin (BTC),

- Ethereum (ETH),

- Ripple (XRP),

- Litecoin (LTC),

- Bitcoin Cash (BCH),

- Cardano (ADA),

- Qtum (QTUM), and

- Ethereum Classic (ETC)

SEPA payments will also be available for any additional cryptocurrencies which we support in future. Click the “More Coins” dropdown menu on our site’s title bar to view the current altcoin selection.

The Limitations of SEPA Transfers

As implied by the name, Single Euro Payments Area transfers are only available for Euro-denominated bank accounts located within the EU region. Participation is therefore limited to the following 33 countries:

- Andorra,

- Austria,

- Belgium,

- Bulgaria,

- Croatia,

- Cyprus,

- Czech Republic,

- Denmark,

- Estonia,

- Finland,

- France,

- Germany,

- Greece,

- Hungary,

- Iceland,

- Ireland,

- Italy,

- Latvia,

- Lichtenstein

- Lithuania,

- Luxembourg,

- Malta,

- Monaco,

- The Netherlands,

- Norway,

- Poland,

- Portugal,

- Romania,

- San Marino,

- Slovakia,

- Slovenia,

- Spain,

- Sweden,

- Switzerland, and

- the United Kingdom